Climate change is an undeniable reality, the current situation across Europe is a big awakening for many. Its impact can significantly affect anyone’s business operations and they span across multiple industries. Understanding these climatic changes and risks that come with them is vital to remaining resilient in the face of uncertainty and this is where future-based Climate Risk Analysis (CRA) provides valuable insights.

Our latest CRA update is designed with the specific focus on making climate change information widely available to anyone, providing new tools and capabilities to empower your decision-making process.

Main advantages include availability globally, within minutes and on self-service basis. This means that after a simple account setup anyone can get CRAs on-demand without fixed costs. Based on the needs, users can choose between two distinct products: taxonomy CRA and expert CRA.

Enhancing Your Climate Scenario Understanding with RCP4.5

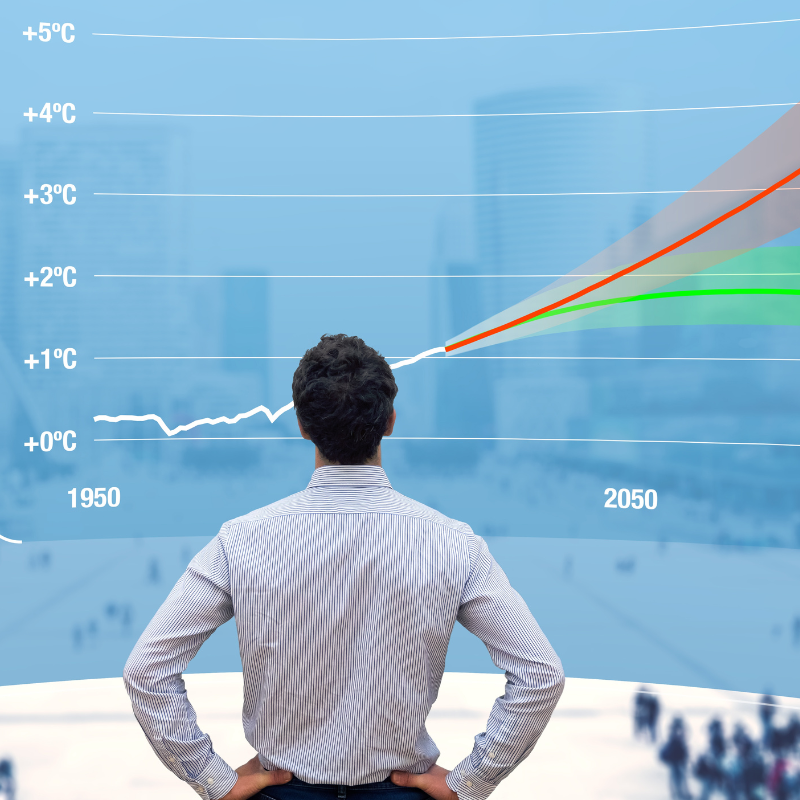

In our refreshed CRA, we have integrated the Representative Concentration Pathway (RCP) 4.5 scenario. This model offers a nuanced forecast where emissions are projected to peak around 2040 and then start to decline, creating a contrast to the existing RCP 8.5 scenario, which envisions emissions steadily increasing throughout the 21st century. Notably, under RCP 4.5, there’s a significant chance of seeing a global temperature increase of between 2°C and 3°C by 2100, accompanied by a mean sea level rise of 35%. This stands as our unwavering commitment ceiling, yet there’s a concerted drive to strive further, aiming for a cap at 1.5°C average global warming.

Tailoring Your Risk Analysis with Risk-Level Filters

We recognize that each real estate endeavor has distinct needs. With the incorporation of our risk-level filters, clients can now concentrate on scenarios most relevant to their property or portfolio and base the analysis on common risk categorization of low, medium, or high. This bespoke approach ensures that our risk assessment aligns seamlessly with the asset, portfolio and strategic objectives of the company, optimizing climate risk management in the real estate domain.

Planning Ahead with Extended Time Horizons

Your ability to foresee and prepare for future challenges is crucial. To support this, we’ve extended the projection period to 2100, offering a longer-term view of potential climate risks, which is specifically important for real estate assets given their long life-expectancies. With this tool, our users can look beyond immediate challenges and develop strategies that strengthen resilience over the long term.

Navigating with Ease through Our New Interface

User experience is one of the most important aspects for us when providing ESG solutions to the market. That’s why we have introduced a new intuitive and user-friendly interface. With this updated design, it’s easier for our users to navigate the tool, visualize the new features, and fully harness its capabilities, making climate risk analysis a smoother process.

Benefits of the Update

Our updated Climate Risk Analysis tool is more than just an upgrade—it’s a user-focused service designed to help anyone navigating the uncertainties of climate change effectively. By integrating the RCP4.5 scenario, risk-level filters, and extended time horizons, we’re offering a more personalized, precise and long-term outlook on climate risks.

The update not only enhances the understanding of potential climate impacts on businesses and their assets but also empowers you to develop effective strategies in response. With these tools at your disposal, we allow our users to be better equipped to navigate the complexities of climate risks, making businesses more resilient, adaptable, and future-ready. After all, the first step towards solving a problem is understanding it and our updated CRA tool is here to aid on that journey.