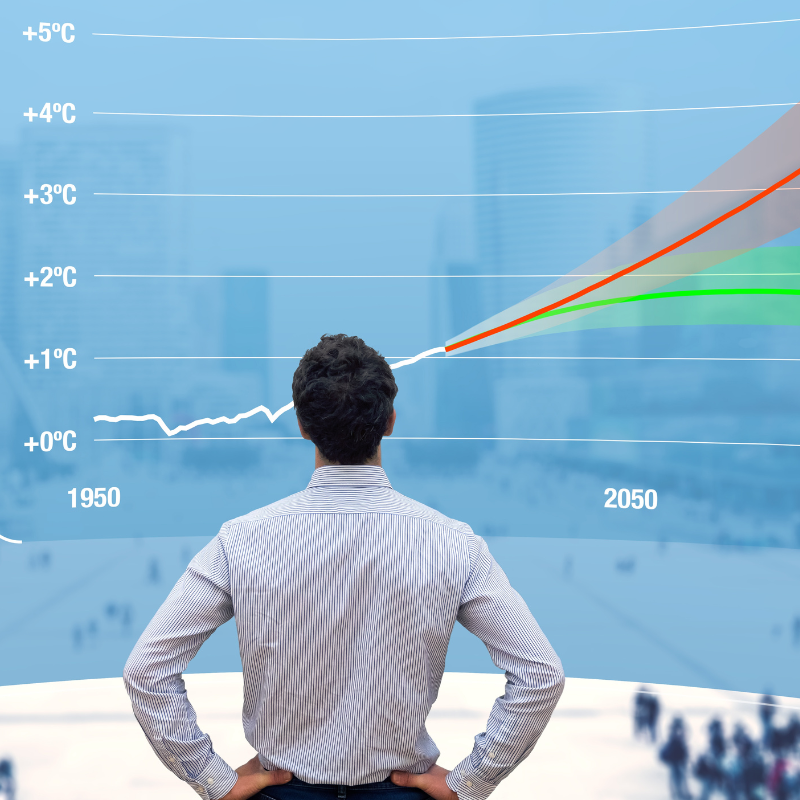

Assessing carbon stranding risk is a vital instrument in today’s environmentally aware business landscape. It helps to synchronize real estate investments with global climate objectives such as the Paris Agreement. By outlining distinct decarbonization pathways, the industry accepted CRREM tool 1 is a key component in blue auditor’s ESG cockpit, which encourages a methodological approach to assess the carbon stranding risk linked to real estate assets and portfolios. This can demonstrate and prove a firm’s dedication to tackling climate change and achieving climate objectives. The consolidation of environmental efforts solidifies the ‘Environmental’ facet of a company’s ESG reporting and enhances stakeholder confidence in the dedication to sustainable practices.

Risk Management

Carbon stranding assessments also play a critical role in risk management related to” Paris Agreement Readiness”, a key component of the ‘Governance’ aspect of ESG principles. As climate-related risks pose significant threats to a company’s performance and reputation in addition to asset valuation, stranding risk assessments give real estate stakeholders a structured and standardized way to identify, quantify, and manage these risks. This systematic approach to risk management facilitates compliance with regulatory obligations tied to climate risk disclosure, thereby contributing to robust corporate governance. Combining stranding risks and asset values in blue auditor, asset management can make educated decisions and prioritize where identified measures can achieve the highest impact on the CO2 performance of portfolios. An in-depth analysis and assessment give clear insights into “assets-at-risk”.

Future-proofing Assets

The use of CO2 stranding assessments in asset management is essential for both current regulatory compliance and for preparing real estate assets for future regulatory changes and shifting market preferences, let alone enhancing the value of real estate by providing detailed decarbonization pathways for properties, CRREM enables the early identification of potential issues that could lead to asset ‘stranding.’ This proactive strategy not only ensures present regulatory compliance but also increases market competitiveness as properties with lower carbon footprints become more valuable to eco-conscious stakeholders. By integrating carbon stranding risk methodologies across different countries with blue auditors CapEx and building auditing feature, asset owners can easily understand how an assets CO2 performance can be improved with already existing and budgeted measures and what may be needed to entirely decarbonize portfolios.

Transparency

Incorporating carbon stranding assessments enhances transparency in ESG reporting, which is pivotal in building stakeholder trust and confidence. blue auditor identifies, quantifies, and illustrates carbon risks in a data-driven manner, providing clear, quantifiable information about a firm’s carbon-related risks. This transparency allows stakeholders, especially investors, to make well-informed decisions, potentially encouraging investment in properties with lower carbon risks.

Investor Confidence

By illustrating a firm’s commitment to mitigating climate change, it validates the firm’s dedication to sustainability. Consequently, this can result in preferential treatment from investors, lenders, and other stakeholders who prioritize sustainability, thereby enhancing the organization’s ability to attract capital and secure favorable loan terms. In effect, this has a direct impact on an assets value: Buildings that demonstrate alignment with the Paris Agreement have a clear advantage over non-performing assets.

Regulatory Compliance

Carbon Stranding Assessments aid in achieving regulatory compliance, which are becoming more important as governments and regulatory bodies increasingly require companies to disclose their climate risks and carbon footprints. By helping to meet these requirements, blue auditor supports the ‘Governance’ aspect of ESG reporting, bolstering the company’s commitment to good corporate governance.

Competitive Advantage

By incorporating carbon stranding analysis into ESG reporting, organizations can gain a significant competitive advantage. This showcases companies’ proactive efforts in mitigating climate change and can distinguish them in the marketplace. Blue auditor supports simple reporting formats to demonstrate such achievements. Furthermore, the analysis sends a strong signal to the market and competitors about the organization’s forward-thinking approach and readiness to adapt to the evolving landscape of carbon regulations and market expectations, further solidifying its competitive position.

In summary, carbon stranding analysis, embedded in blue auditor’s ESG cockpit, serves as a strategic asset in battling climate change, demonstrating responsible governance, securing long-term asset value, and ensuring regulatory compliance. Its use in ESG reporting not only improves transparency but also strengthens investor confidence, potentially yielding numerous benefits such as enhanced investment prospects, reputational gains, and more robust stakeholder relationships.

By incorporating carbon stranding analysis into ESG reporting, organizations can gain a significant competitive advantage. This showcases companies’ proactive efforts in mitigating climate change and can distinguish them in the marketplace. Blue auditor supports simple reporting formats to demonstrate such achievements. Furthermore, the analysis sends a strong signal to the market and competitors about the organization’s forward-thinking approach and readiness to adapt to the evolving landscape of carbon regulations and market expectations, further solidifying its competitive position.

In summary, carbon stranding analysis, embedded in blue auditor’s ESG cockpit, serves as a strategic asset in battling climate change, demonstrating responsible governance, securing long-term asset value, and ensuring regulatory compliance. Its use in ESG reporting not only improves transparency but also strengthens investor confidence, potentially yielding numerous benefits such as enhanced investment prospects, reputational gains, and more robust stakeholder relationships.

1CRREM – Carbon Risk Real Estate Monitor is an EU-funded Horizon 2020 project developed by five well-known institutions from various European countries